FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

Conservation easements and real estate investments are two popular tools for offsetting ordinary income tax. How do you know which one is right for you? This article explains what these strategies are and when they make sense.

A conservation easement is a legal agreement between a landowner and a qualified organization, such as a land trust or a government agency, that restricts the development of the land in perpetuity, protecting wildlife habitats or preserving historic sites even if the property is later sold or passed down to future generations. Conservation easements, in short, are a way for landowners to protect property from future development, no matter who ends up in control of the land in the future.

Conservation easements are also a tax tool. When you agree to restrict the use of your land for conservation reasons, the government considers that a type of charitable donation, and you get a charitable deduction based on the lost value of the land. In practice, taxpayers often claim a value that is a multiple of the value at which the land was purchased. This deduction can be used to offset ordinary income up to 30% of the donor’s adjusted gross income (AGI), with any excess carried forward for up to five years.

Because a number of players in the space are unscrupulous, the IRS has become concerned in recent years that the tax code’s conservation easement rules are being exploited. Certain types of conservation easements are now considered “listed transactions” that must be flagged for the IRS. Sen. Ron Wyden, chair of the Senate Finance Committee, has been consistently critical of conservation easements, which he describes as “a tax shelter gold mine.”

Gabriel, a single New Jersey resident, earns $1,200,000 per year. His annual tax bill is $550,000. Gabriel happens to be an avid conservationist with an appetite for risk. Tired of paying so much tax on his salary, Gabriel purchased a $100,000 property fours years ago and this year he put a conservation easement on the land to protect it from future development. The easement is valued at $350,000 and he is allowed to deduct this entire amount from his income, reducing his taxable income by $350,000 this year. If his marginal tax rate is 50%, that will save him close to $175,000, effectively reducing his taxes this year from $550,000 to under $375,000.

This article uses “real estate investment” broadly to mean any investment involving the purchase, sale, management, or leasing of property for profit. Real estate investors can benefit from several tax-saving strategies, but depreciation (specifically accelerated depreciation) is the most important for people looking to reduce their ordinary income taxes. Critically, to offset ordinary income with real estate depreciation, you need to be a real estate professional, which means spending more than 500 or 750 hours in a year on your real estate business. For practical purposes, that means you can’t have another job. But if your spouse doesn’t have a full-time job (and wants to spend 750 hours per year on real estate), or you don’t have a full-time job (and want to spend 750 hours per year on real estate), it can work.

Kevin, a married New Jersey resident who is a real estate developer, is earning $1,000,000 with a $420,000 annual tax bill. In the past, he has only invested in stock indexes. Tired of paying so much tax on his salary, Kevin buys a $500,000 duplex and rents it out. He deducts 60% of this amount as depreciation in the first year, reducing his taxable income by $300,000 that year. If his marginal tax rate is 50%, that will save him $150,000, effectively reducing his taxes in that year from $420,000 to about $270,000 (not including the income tax generated by the rental). Due to leverage, he may have only had to invest $100,000 in the property upfront, with the rest covered by loans. The loan interest will also be deductible, reducing his taxable income by another $20,000 or so. In future years, he’ll be able to deduct additional depreciation as well as interest on the loan. That said, taking on leverage is risky and means that Kevin will have to cover the interest and principal payments as they come due. Kevin or his spouse will also have to qualify as a real estate professional in order to use the depreciation to offset his ordinary income.

Creating conservation easements and investing in real estate are both potentially attractive tax strategies. Both generate upfront deductions, though only real estate generates ongoing cashflow. Conservation easements require no work on the taxpayer’s part, but they also subject the taxpayer to potential legal risks. Real estate investments are more conservative legally but require significant time commitments if a taxpayer is looking to offset non-real estate income. The right strategy for any given person will depend on a person’s risk tolerance as well as how they assess the pro’s and con’s of each approach.

Conservation easements and real estate investments are popular strategies for reducing ordinary income tax exposure. Hopefully this article has given you a better idea of what each strategy entails, and whether one or the other might be a better fit.

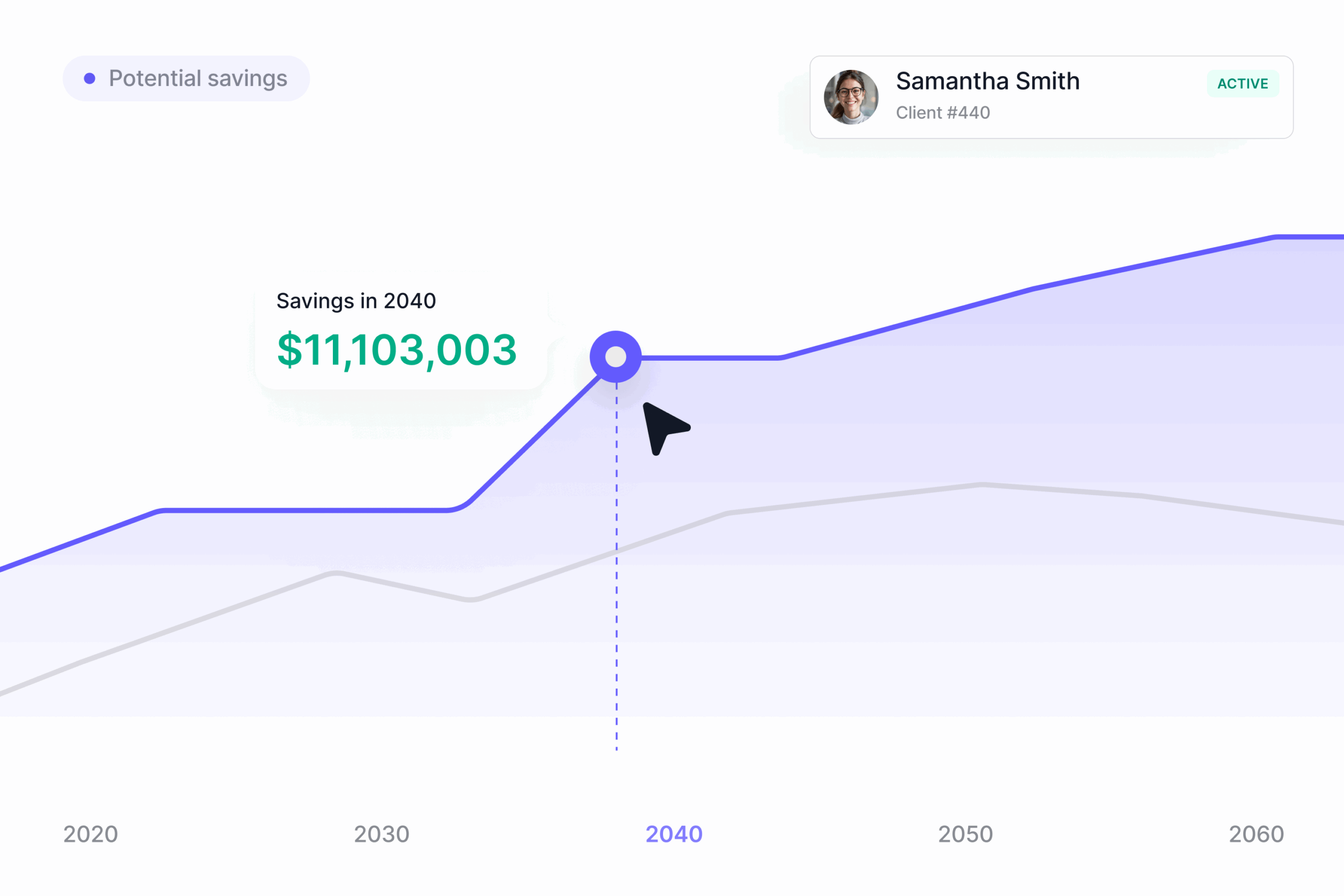

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to talk through your options?

Free 15-min consult · No obligation · Ordinary Income