FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

Investing in oil and gas wells and investing in real estate are two popular strategies for offsetting ordinary income tax. How do you know which one is right for you? This article explains what these strategies are and when they make sense.

Oil and gas drilling investments are exactly what they sound like: investments in oil and gas drilling partnerships. These projects offer substantial tax benefits that can offset ordinary income tax while generating significant income for investors. Best of all, they don’t require investors to do anything other than invest to be considered active.

A taxpayer is able to claim depreciation on oil and gas well investments. This means that a taxpayer who invests in oil and gas wells will be able to deduct the cost of the investment — and typically, the vast majority can be deducted in the first year. Intangible drilling costs (IDCs), which include labor, fuel, and chemicals, are 100% deductible in the first year and can comprise as much as 94% of an oil and gas well investment. Tangible drilling costs, which include project expenses not considered IDCs, are deductible over the course of several years, rather than all upfront.

For example, if you are a top marginal taxpayer in New York City, you could invest $100,000 into oil and gas drilling projects and offset $94,000 of your ordinary income in the first year, saving $50,000 on taxes that year ($94,000 * 53% marginal tax rate)! Much of the remaining $6,000 would be deductible in subsequent years.

In general, U.S. law requires taxpayers to be “active” in an investment in order to use tax credits or depreciation from that investment to offset active income like a salary or income from a business. For example, depreciation from a “passive” real estate investment — one where you buy a property and rent it out without being actively involved — can only be used to reduce your passive rental income. To offset active income, you need losses from a business in which you are actively involved. Typically that means 100+ hours (in some cases 750+ hours) of activity in the business. But oil and gas investments are not subject to this requirement due to a 1913 law, so you can qualify as active without doing any work.

John, a married New Yorker earning $1,200,000 per year, mostly from his W-2 job, historically has invested only in stock indexes. Tired of his $550,000 annual tax bill, John invests $300,000 in an oil drilling partnership. He deducts 94% of this amount as intangible drilling costs in the first year, reducing his taxable income by $282,000 that year (and another $18,000 over the next five years as a result of depreciation for tangible drilling costs). If his marginal tax rate is 51%, that will save him close to $153,000, effectively reducing his at-risk principal to just $147,000 ($300,000 – $153,000), even as John generates returns on his full $300,000 investment. You can estimate your potential returns here!

This article uses “real estate investment” broadly to mean any investment involving the purchase, sale, management, or leasing of property for profit. Real estate investors can benefit from several tax-saving strategies, but depreciation (specifically accelerated depreciation) is the most important for people looking to reduce their ordinary income taxes. Critically, to offset ordinary income with real estate depreciation, you need to be a real estate professional, which means spending more than 500 or 750 hours in a year on your real estate business. For practical purposes, that means you can’t have another job. But if your spouse doesn’t have a full-time job (and wants to spend 750 hours per year on real estate), or you don’t have a full-time job (and want to spend 750 hours per year on real estate), it can work.

Kevin, a married New Jersey resident who is a real estate developer, is earning $1,000,000 with a $420,000 annual tax bill. In the past, he has only invested in stock indexes. Tired of paying so much tax on his salary, Kevin buys a $500,000 duplex and rents it out. He deducts 60% of this amount as depreciation in the first year, reducing his taxable income by $300,000 that year. If his marginal tax rate is 50%, that will save him $150,000, effectively reducing his taxes in that year from $420,000 to about $270,000 (not including the income tax generated by the rental). Due to leverage, he may have only had to invest $100,000 in the property upfront, with the rest covered by loans. The loan interest will also be deductible, reducing his taxable income by another $20,000 or so. In future years, he’ll be able to deduct additional depreciation as well as interest on the loan. That said, taking on leverage is risky and means that Kevin will have to cover the interest and principal payments as they come due. Kevin or his spouse will also have to qualify as a real estate professional in order to use the depreciation to offset his ordinary income.

Investing in oil and gas wells and investing in real estate are both potentially attractive strategies. Both generate depreciation deductions plus investment returns. From a pure tax perspective, oil and gas well investments will generally be more attractive, especially in light of the material participation requirements for real estate investments. One major factor, which is hard to generalize, is whether oil and gas wells will yield higher investment returns than a given real estate investment.

Investing in oil and gas wells and investing in real estate are both viable tax strategies, but they serve different objectives. Hopefully this article has given you a better idea of what each strategy entails, and whether one or the other might be a better fit.

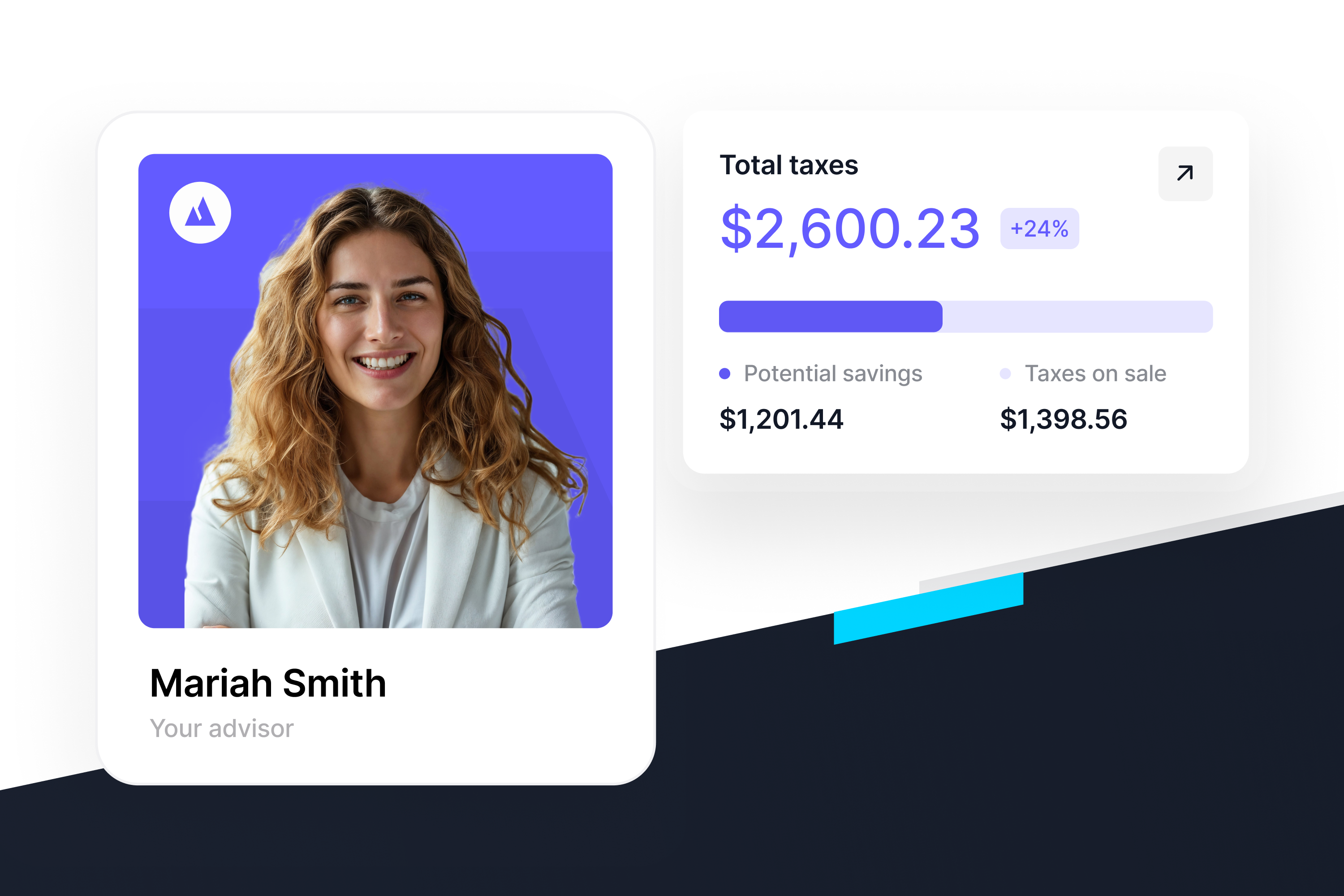

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!