FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

Irrevocable Life Insurance Trust (ILITs) and Grantor Retained Annuity Trusts (GRATs) are two popular types of irrevocable trusts. How do you know which one is right for you? This article explains what these trusts are and when they make sense.

An ILIT is a type of irrevocable trust that is designed to hold insurance. A person (the “grantor”) creates an ILIT for the benefit of one or more loved ones — such as children, grandchildren, a spouse, or siblings. Typically, the grantor funds the trust with cash, which the trust uses to acquire one or more life insurance policies, often on the grantor’s life. Once the life insurance policy is in the trust, it is outside of the grantor’s estate, and the proceeds will not be subject to gift tax, estate tax, or generation-skipping transfer tax. Because life insurance policies generally are not subject to income tax, ILITs are able to generate both income-tax savings (via the insurance policy) and estate-tax savings (via the trust). It’s possible for ILITs to own assets aside from life insurance, though generally they stick to holding life insurance policies plus a small amount of liquidity.

ILITs can hold any type of life insurance policy, from indexed universal life insurance (IUL) to term life insurance. But a specific type of variable universal life insurance policy, known as Private Placement Life Insurance (PPLI), works particularly well with ILITs and has become quite popular with high-net-worth individuals who are looking to transfer as much post-tax wealth to their family members as possible. Even after accounting for the fees that life insurance companies charge, an ILIT funded with PPLI will generally outperform other estate-tax strategies. (You can learn more about ILITs here.)

Imagine that Ronald is a 40-year-old New York City resident with a $25 million net worth and a portfolio that generates 9% annual returns (divided equally between capital appreciation and cashflow). If Ronald sets up an ILIT and then contributes $6 million to fund premiums on a PPLI policy, he will use up $6 million of his lifetime gift tax exemption, but the investments in the life insurance policy will be able to grow outside of his taxable estate. Even after fees, the policy will generate more than 8% annual post-tax returns. Meanwhile, the insurance charges will pay for a generous death benefit. If Ronald dies in Year 25, his beneficiaries will receive roughly $59.9 million of cash proceeds from the ILIT, and the total tax savings for his heirs will be about $39.9 million relative to if Ronald had done nothing.

A GRAT is a type of irrevocable trust that moves assets out of a person’s taxable estate without using that person’s lifetime gift and estate tax exemption. It’s a powerful gift and estate tax strategy. The basic idea is that a person (the “grantor”) transfers an asset to the GRAT and sets an annuity term (usually two years). A portion of the principal is returned to the grantor each year until the end of the term. The exact size of each annuity payment is based on a standardized formula, but basically the grantor is entitled to receive the full amount of the original principal amount plus interest that is based on the government’s interest rate, known as the “7520 rate.” By the end of the term, the original principal (plus some interest) has been returned to the grantor. Any remaining amount in the trust passes to the grantor’s named beneficiaries free of estate tax or gift tax. The GRAT’s magic comes from the ability to transfer wealth to beneficiaries free of tax by simply funding the trust with assets that outperform the 7520 rate. The 7520 rate is equal to roughly 120% of the yield on a 7-Year Treasury Note, so it typically comes out to somewhere in the 3%-5% range. (You can learn more about GRATs here and you can estimate the potential returns here.)

Imagine that Christine is a New York City resident with a $25 million net worth and a portfolio that generates 9% annual returns (divided equally between capital appreciation and cashflow). If she contributes $6 million to a two-year GRAT when the 7520 rate is 4%, the GRAT will pay her approximately $6.3 million over the course of the first two years. But because the GRAT’s assets are appreciating at 9% while the 7520 rate is only 4%, there will be a remainder left over at the end of Year 2. That remainder — about $500,000 — will pass to Christine’s remainder beneficiary, perhaps a grantor trust for the benefit of her daughter. If Christine decides to set up “Rolling GRATs” — that is, GRATs where the annuity payments are used to fund new GRATs — and she keeps setting up new GRATs each year for 25 years and naming the grantor trust for her daughter as the remainder beneficiary, by Year 25 she will have transferred about $33.1 million to trusts for her daughter, saving her daughter the equivalent of about $14.5 million of tax.

GRATs funded during two-year periods where Christine’s investments performed poorly would fail, but Christine and her daughter would be no worse off than if Christine hadn’t funded the GRAT (aside from the cost of setting up the GRAT).

Note that in this example the GRATs don’t transfer as much wealth as the ILIT described above. But that’s not always the case. If the assumed returns had been higher or more volatile, the GRAT could have easily outperformed.

ILITs and GRATs both save estate tax, but there are crucial differences between them.

ILITs are generally more tax efficient overall, because ILITs (or the assets they hold) can avoid income tax. They’re also more GST efficient than GRATs. However, taking advantage of the full potential of an ILIT requires acquiring income-producing assets — like private credit — inside of a permanent insurance policy. Some people don’t want to invest in income-producing assets. Others simply don’t trust permanent insurance and would rather pursue non-insurance options. For such people, a GRAT (or other type of trust) funded with some other asset type might be a better fit.

GRATs are ideal for people with volatile assets that are easy to value, like individual stocks or crypto, who are looking to transfer assets to their children. GRATs are particularly useful for people who have limited unused lifetime gift tax exemption, since GRATs don’t require lifetime gift tax exemption in order to work.

It is important to note that there are lots of other gift and estate tax strategies that may make more sense than an ILIT or a GRAT, depending on circumstances. Those strategies are also worth exploring. Moreover, ILITs and GRATs are not mutually exclusive; some people set up both.

ILITs and GRATs are both powerful tax strategies. ILITs make sense for people who are looking to make large gifts and want to maximize their heirs’ tax savings. GRATs make sense for people with volatile assets who are looking to transfer assets to a trust without using any lifetime gift tax exemption.

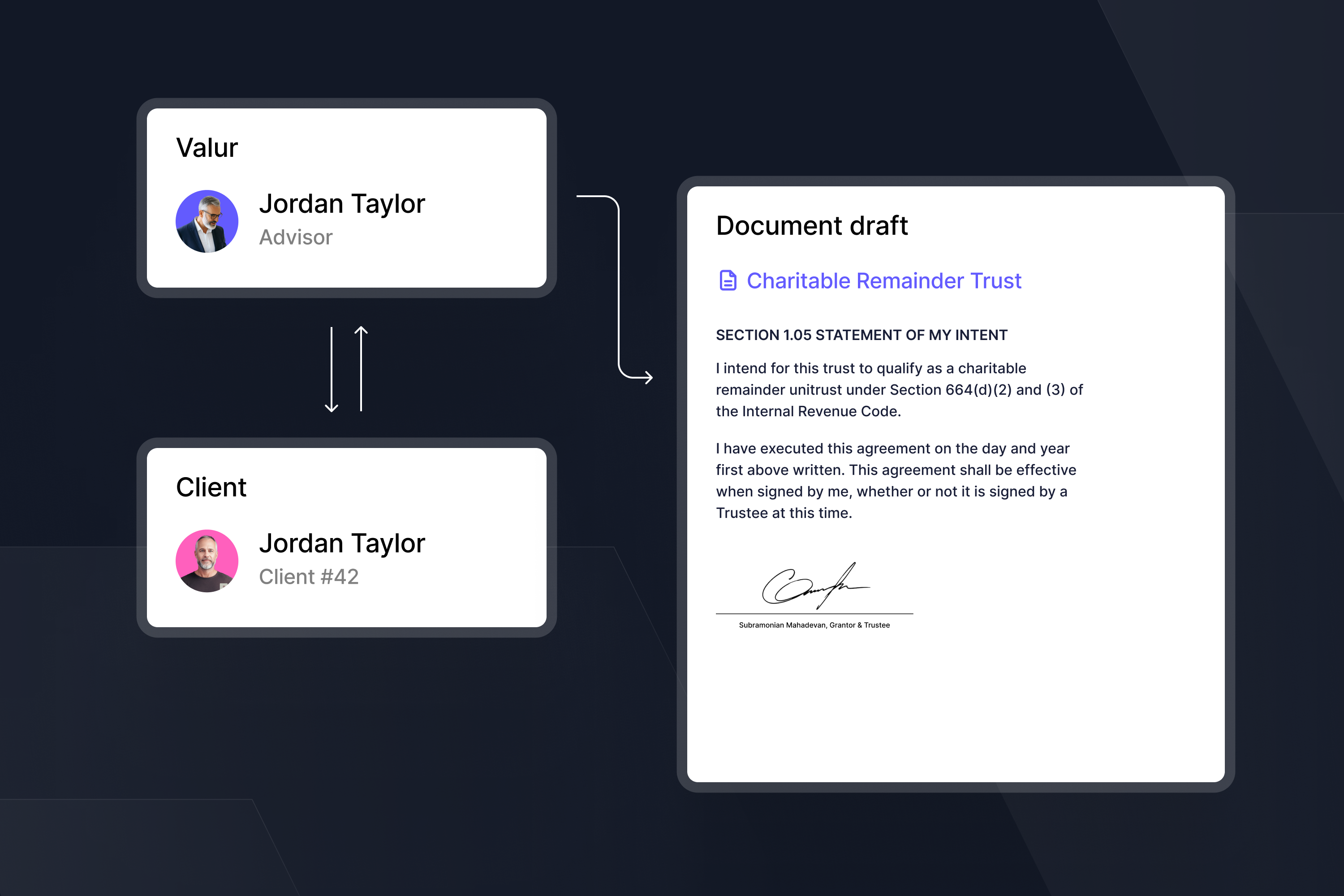

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to talk through your options?

Free 15-min consult · No obligation · Estate Tax