FEATURED ARTICLE

Tax Planning for Realized Gains and Ordinary Income

Tax planning strategies for realized gains and ordinary income

Tax planning strategies for realized gains and ordinary income

With most grantor retained annuity trusts (“GRATs“), the annuities are set up to be paid at the end of the year rather than at the beginning of the year. But they don’t have to be. A GRAT can be structured to make the annuity payment at the beginning of each year. When the payment is made at the beginning of the year, the present value of the annuity payments is slightly higher, since the payments are being made at the start of the period rather than at the end. GRAT annuity payment timing is an important factor to consider.

Breaking Down the GRAT Structure and Payment Timing

Understanding GRATs: A GRAT is a financial instrument commonly used to minimize taxes on large gifts (most often on gifts to children). An individual (the “grantor”) transfers assets to a trust for a set period, usually two years. During this period, the trust pays an annuity to the grantor each year, and at the end of the term, the remaining assets pass to the beneficiaries without any gift tax consequences.

Timing of Annuity Payments: The timing of annuity payments from a GRAT can affect the size of the annuity payments. Payments can be structured to occur at the beginning of the year or at the end.

Beginning-of-Year Payments: Choosing to make annuity payments at the beginning of the year can have subtle but important implications:

End-of-Year Payments: The more common end-of-year payment structure allows the assets to potentially grow for a full year before the annuity is paid, which can be advantageous for the trust’s growth and leave more behind for the trust beneficiaries gift and estate tax free. This is why this is the standard approach for GRATs.

Conclusion and Next Steps: The decision on the timing of annuity payments from a GRAT should be made with careful consideration of the financial and tax implications. That said, it’s more tax efficient to defer the annuity payments as long as possible. If a grantor is concerned about liquidity, it may make more sense to simply transfer a smaller amount of assets to the trust.

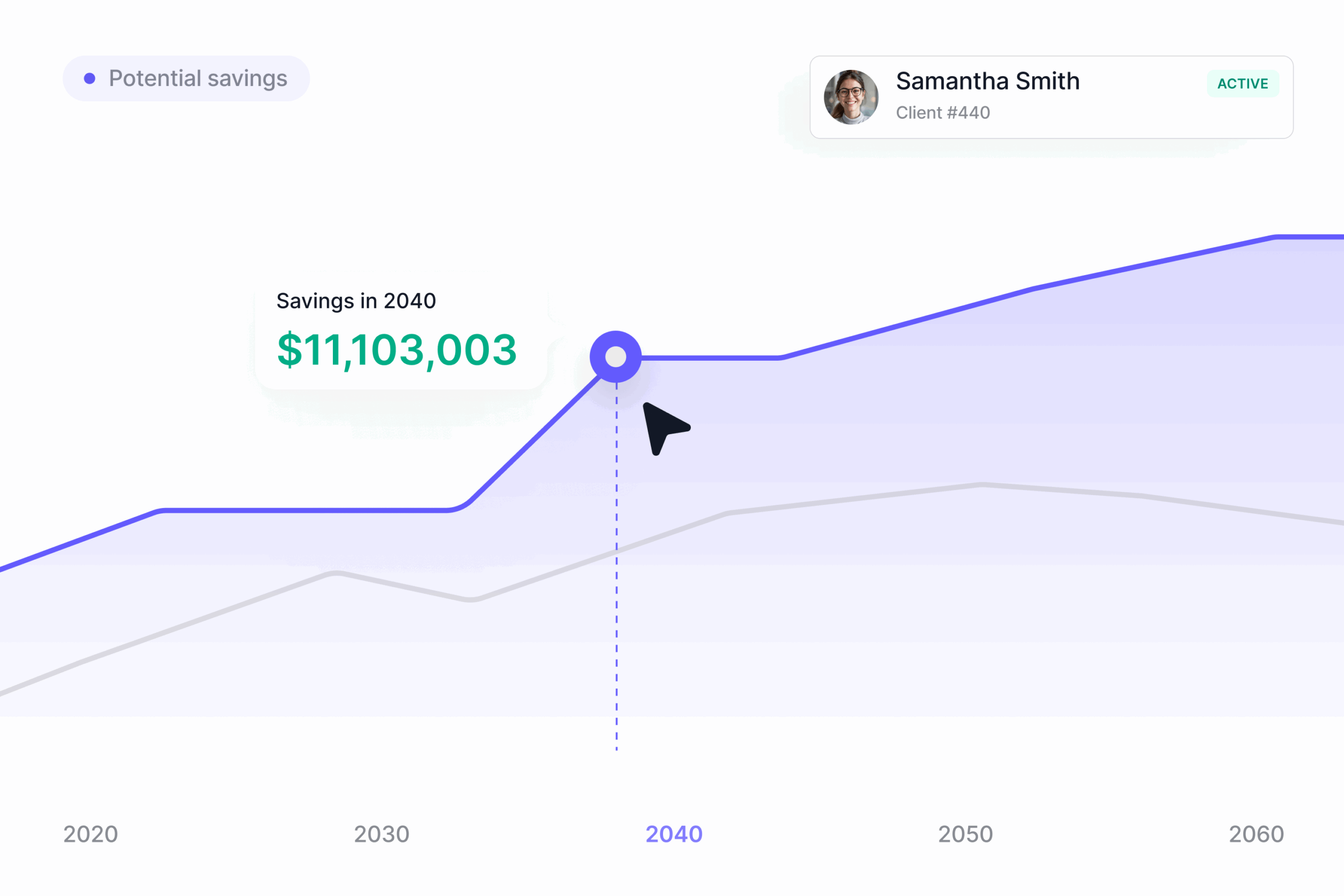

We’ve built a platform that makes advanced tax planning – once reserved for ultra-high-net-worth individuals – accessible to everyone. With Valur, you can reduce your taxes by six figures or more, at less than half the cost of traditional providers.

From selecting the right strategy to handling setup, administration, and ongoing optimization, we take care of the hard work so you don’t have to. The results speak for themselves: our customers have generated over $3 billion in additional wealth through our platform.

Want to see what Valur can do for you or your clients? Explore our Learning Center, use our online calculators to estimate your potential savings or schedule a time to chat with us today!

Ready to talk through your options?

Free 15-min consult · No obligation · Estate Tax